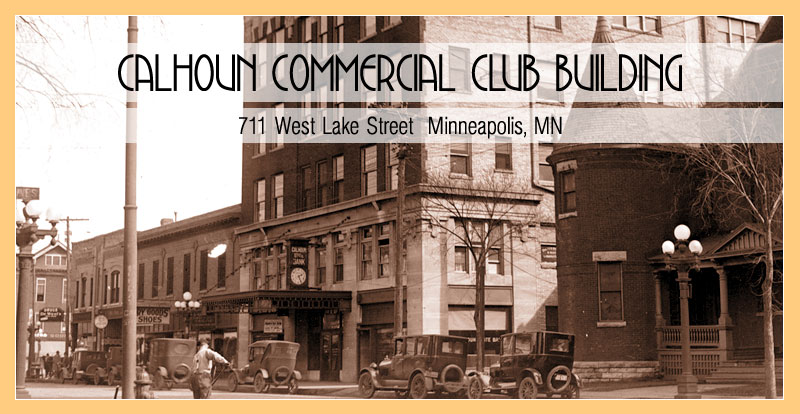

Calhoun Commercial Club Building

711 West Lake Street, Minneapolis, MN

gp-1

gp-2

gp-3

gp-4

gp-5

gp-6

gp-7

gp-8

gp-9

gp-10

For Rent

Leasing Call Mike Murphy : 612.270.8729

Remarks:

The Calhoun Building at Lyndale and Lake Street has a variety of units available for studio or office use.

- Available spaces vary in size from 400 sq ft- 700 sq ft

- Units rent from $375 – $800

- Longtime home to numerous dance, theater, music and arts organizations

- Natural light, views of Lake Street, Lyndale Avenue, downtown Minneapolis

- Off-street parking, elevator, nearby restrooms

- Some units have private sinks, partitions, separate spaces

- Well-preserved aesthetic, attentive management