What's your home worth?

Get a FREE Comparative Market Analysis in today's market.

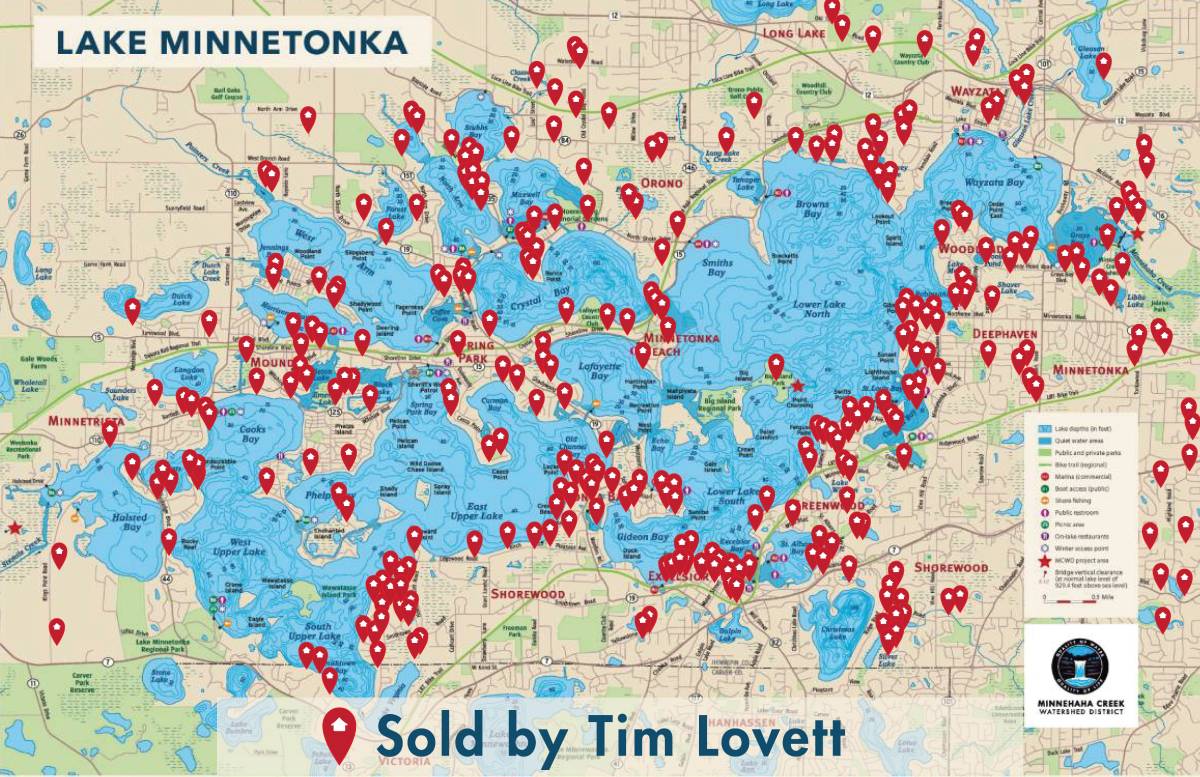

Click to Search for Current Listings in Lake Minnetonka Communities

Lake Minnetonka Communities

Lake Minnetonka is a lake located about 16 miles west-southwest of Minneapolis, Minnesota. Lake Minnetonka has about 23 named bays and areas. The lake lies within Hennepin and Carver counties and is surrounded by 13 incorporated municipalities. At 14,528 acres, it is Minnesota's ninth largest lake.

At more than 14,000 acres in size, Lake Minnetonka is the largest lake in the Twin Cities metropolitan area. It is a system of basins with a range of fertility, bottom types, and depths, and is the source of Minnehaha Creek.

Minnetonka's size and location make it very popular for year-round recreation, so demands on its aquatic resources are varied and great.

This vast, interconnected system has a large, diverse fish community. A high-quality largemouth bass population draws multiple tournaments every year. Sunfish and crappies provide year-round fishing. A noteworthy muskie fishery has been established from stockings started in the late 1970s. Northern pike and walleye are predator-fish mainstays.

ASK ME ABOUT WHAT'S COMING TO MARKET!

Your lakeshore dream or your next home - I can offer insights on upcoming sales.

Let's Connect!

I would love to hear from you about your lakeshore dreams.

tim@mrlakeshore.com

235 Lake Street East #100 · Wayzata, MN 55391